Over the past ten years, low cargo rates and the unprofitability of the cargo business have led many airlines to lay down or scale back their dedicated cargo freighter fleets.

However, the industry could not be kept down as air cargo has always been the key ‘driver’ of global supply chains. During the COVID-19 pandemic, the efficiency and importance of air cargo came under the spotlight: it enabled the efficient delivery of life-saving personal protective equipment (PPE), masks, medical supplies and vaccines during the global crisis. The surge in e-commerce and increased demand for daily essentials and products could also be met despite supply disruptions.

The IATA Annual Review 2022 reported that in 2021, air cargo generated US$155 billion, up from US$129 billion in 2020 and US$101 billion in 2019.

Air cargo in 2021 grew by 53.5 percent from 2019, whilst 2020 revenue grew by 27.7 percent. This means that air cargo in 2021 accounted for double its 2020 contribution in airline revenues. Global demand for air cargo went up by 6.9 percent compared with pre-COVID level in 2019 and up 18.7 percent compared with the level in 2020. Air cargo capacity, measured in available cargo tonne kilometers (ACTKs) in 2021, however was 10.9 percent below the level in 2019 (-12.8 percent for international operations).

With revenues from transporting goods by air having risen by 53.5 percent in 2021 (from 2019) – at a value of US$155 billion – demand for air freight continues to soar.

On the home front, Singapore’s Changi Airport has maintained its extensive cargo network throughout the COVID-19 pandemic.

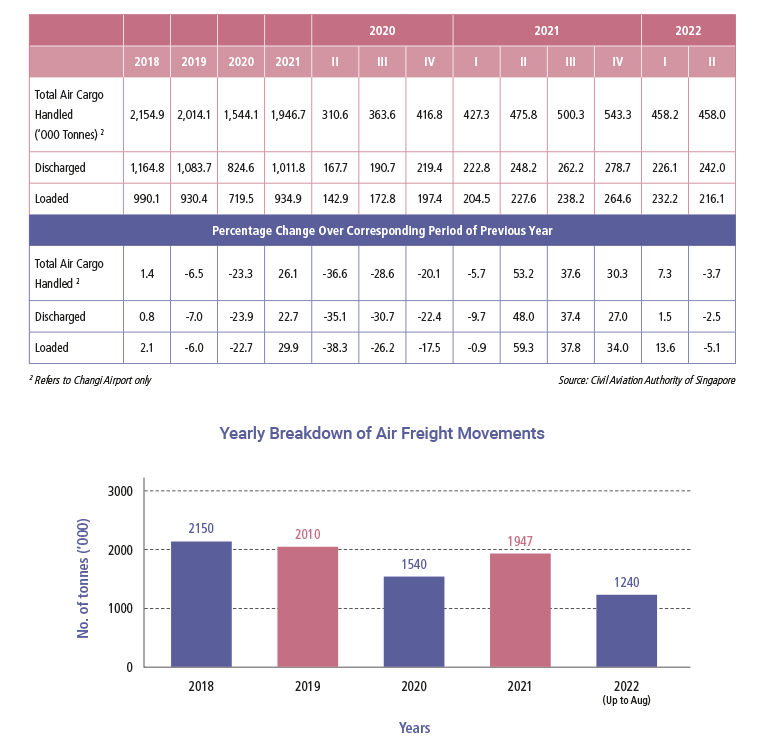

Air freight movements at Changi Airport in Singapore Second Quarter 2022

According to data provided by Civil Aviation Authority of Singapore (CAAS), total airfreight throughput in 2021 hit 1.95 million metric tons (mmt). It was a 26.6 percent jump from 2020, when throughput for the full year fell to 1.54 mmt - from 2.01 mmt in 2019 - at the height of pandemic restrictions and lockdowns worldwide.

For the second quarter of the year 2022, air freight movements totalled 458,000 tonnes, a year-on-year decline of 3.7 percent and a reversal from the 7.3 percent growth recorded in the previous quarter. Supply chain disruptions arising from COVID-19 lockdowns in China and geopolitical tensions impacted air cargo traffic, particularly during April and May 2022. Second quarter 2022 top five air cargo markets were China, Hong Kong, Australia, United States of America and Japan.

Changi Airport Group (CAG) report card on air cargo activities

CAG noted that throughput for September and October 2021 surpassed 2019 benchmarks, with air imports and exports from January to November 2021 exceeding pre-pandemic levels by 8 percent.

In 2021, more than 50 passenger airlines launched over 23,000 flights carrying only cargo to and from Changi Airport. At the end of 2021, South Korean budget carrier Air Premia launched a weekly flight from Incheon city to Singapore using converted passenger planes to bring in COVID-19 test kits, e-commerce goods, fabric, and agricultural products including strawberries. The outbound cargo included perfumes, cosmetics, food products and electronic parts. Air Premia was preceded by the addition of Australia’s Tasman Cargo in June and India’s SpiceJet in February 2021. In October 2021, to meet surging demand in e-commerce, FedEx Express doubled its weekly flights between Sydney and Singapore, and added a new weekly flight connecting Singapore with Paris. By December 2021, Changi Airport registered some 1,000 weekly scheduled and charter cargo flights - including passenger aircraft converted to carry cargo in their holds - connecting Singapore to more than 70 cities. This was a threefold increase compared to the year before.

“Changi Airport Group has worked closely with industry partners to facilitate airfreight movements, which has supported the Singapore economy and ensured the flow of essential goods globally. With our partners, we are also driving efforts to digitise the air cargo supply chain and build long-term resilience with a stronger freighter network. These efforts will strengthen the Changi air cargo hub to meet the challenges of tomorrow.

Mr Lim Ching Kiat

Changi Airport Group’s (CAG) managing director of air hub development.”

Changi Airport’s recovery reflects the latest air cargo trends reported by IATA, which noted that global demand in 2021 was up 6.9 percent compared with pre-COVID level in 2019.

To boost capacity, the Civil Aviation Authority of Singapore (CAAS) and CAG works closely with airline partners to introduce passenger aircraft for cargo conveyance operations, expand their freighter operations, and introduce new freighter operators.

In November 2021, Maersk, the Danish maritime and land logistics company, ordered two new Boeing 777Fs while leasing three more 767-300 cargo planes for its Star Air division.

Then in April 2022, responding to increased demand from its customers, Maersk announced the launch of Maersk Air Cargo. The new air freight company took over from its existing in-house aircraft operator, Star Air, which had transferred activities, to support existing and new customers and Maersk’s end-to-end logistics.

In order to ramp up air freight capacity, network, and know-how, Maersk acquired a global freight forwarding company Senator International in June 2022, which has an operational air freight platform of own-controlled capacity and operations across Europe, Asia, South Africa and America. Their acquisition increased the company’s ability to provide flexible logistic solutions, and accelerate or slow cargo transportation in line with evolving supply chain needs.

On 20 December 2021, CMA CGM Group, a world-leader in shipping and logistics, firmed up an order with Airbus, for the purchase of four A350F freighter aircraft, bringing the shipping line’s total Airbus fleet to nine aircraft, including four A330-200F and one A330-200 to be converted into a freighter. In March 2021, CMA CGM launched a new air freight division with four Boeing 777 aircraft. It purchased two more in November. CMA CGM AIR CARGO fleet currently consists of 6 aircraft. By 2026, CMA CGM AIR CARGO fleet will go up to 12.

Airbus has received more freighter orders as cargo and logistics companies invest in air transport to bypass port delays, and as pressure from consumers to deliver goods as quickly as possible mounts. Mr James Christopher, president of supply chain consultancy TMX Asia, said that “with e-commerce, consumer expectations have shifted dramatically. While they want the convenience of home delivery, they also want the speed which they are used to from shopping at traditional brick-and-mortar stores”.

On 22 December 2021, Boeing announced an order for 19 767 Freighters from United Parcel Service (UPS) as the global shipping and logistics company ramps up its capacity to meet rising demand for transporting cargo by air. The new planes, valued at US$1.5 billion (S$2.05 billion) are slated to be delivered between 2023 and 2025. The UPS order adds to a record-breaking year for Boeing freighter sales, including 80 firm orders for new widebody freighters and more than 80 orders for Boeing Converted Freighters.

On 17 February 2022, Singapore Airlines (SIA) announced that they had firmed up an order for seven more Airbus A350 Freighters, with options on a further five aircraft. The new generation aircraft which offers better fuel economy, longer range and greater deployment flexibility will replace SIA’s seven Boeing 747-400 freighters.

On 16 August 2022, DHL Express, the world’s leading international express service provider, welcomed the arrival of the first of five new Boeing 777 freighters to be operated under a crew and maintenance agreement signed in March 2022. SIA will operate it on routes to the United States of America via South Korea thrice weekly from August 2022.

As air cargo demands grow, so has the demand for converted passenger planes.

On 3 March 2022, Air Transport Services Group, Inc. (ATSG), the world’s largest lessor of freighter aircraft, committed to a total of 29 Airbus A330 Passenger-to-Freighter (P2F) conversion slots with Elbe Flugzeugwerke (EFW), center of excellence for Airbus freighter conversions and a joint venture between ST Engineering and Airbus. The commitment reflects a strategic step by ATSG to diversify its existing in-service fleet of 117 aircraft with the addition of next-generation widebody freighters.

To meet the rising demand for freighter conversions, ST Engineering and EFW are setting up new conversion sites in China and the U.S. this year, and are ramping up conversion capacity for all their Airbus P2F programmes to over 60 slots per year by 2024.

On 15 July 2022, Elbe Flugzeugwerke (EFW) and ST Engineering delivered the world’s first Airbus A320P2F (Passenger-to-Freighter) to its launch customer Vaayu in Singapore. The aircraft will join the other Airbus P2F versions already in operation: the A321P2F, the A330-200P2F and the A330-300P2F. The delivery comes at a ripe time as demand for converted freighters continues to surge. The aircraft will be part of the fleet of Pradhaan Air Express, a new cargo airline in India and a sub-lessee of Vaayu. A second aircraft is scheduled to join later this year. The A320P2F, owned by ST Engineering’s aviation asset management business division, is the first of several converted freighters to be leased to Vaayu.

Singapore Air Freight Rankings

Busiest airports for Cargo Traffic 2021

From the Airports Council International (ACI), an authority on airport data and statistics worldwide, Singapore ranked 17th for the world’s top busiest airports for cargo traffic in 2021.

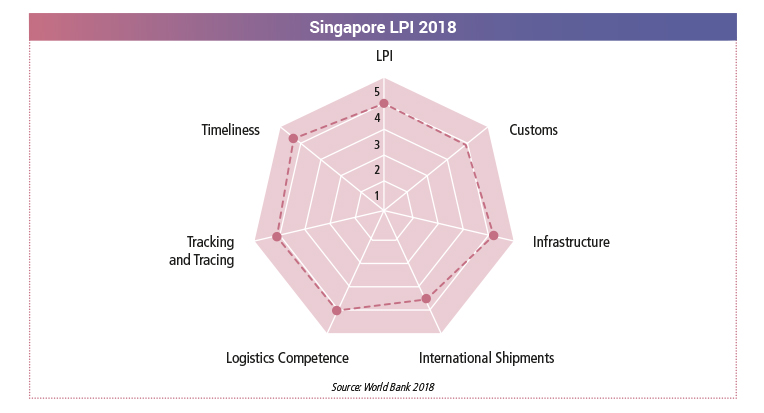

World Bank Ranking

From the 2018 Logistics Performance Index (LPI), Singapore ranked 7th, with an LPI score of 4.

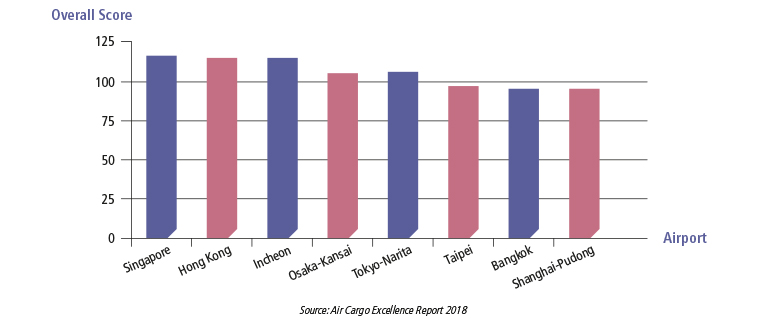

Air Cargo Excellence Report

Singapore’s Changi Airport is also the best global air cargo airport for Performance, Value and Facilities.

Air Freight Movement Statistics